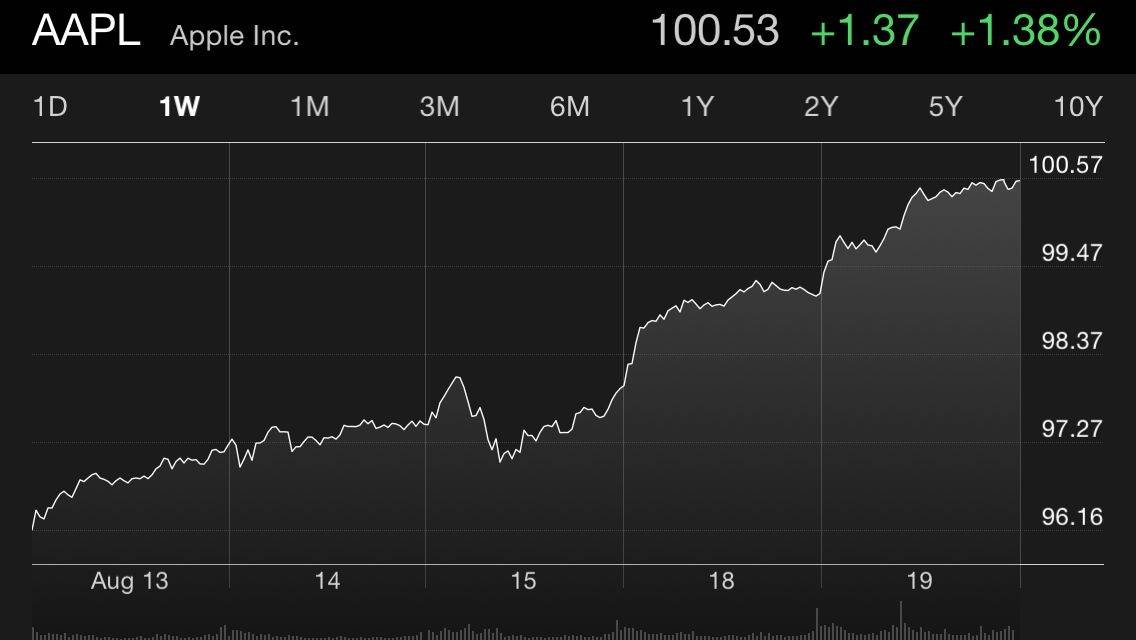

AAPL shares have finally completed the long climb back to 2012 levels today, closing at an all-time high of $100.53 per share.

The stock’s 1.4 percent rise today was aided by bullish reports from both RBC and Morgan Stanley claiming Apple’s Fall lineup is going to be more extraordinary than ever this year as Apple puts the final preparations on the iPhone 6.

![Apple Might Borrow Money To Double Dividend Paid To Investors [Rumor] Tim Cook, Phil Schiller and others sold Apple stock at a time when it was hitting record highs.](https://www.cultofmac.com/wp-content/uploads/2013/02/apple-money-logo.jpg)