Disney has officially completed its acquisition of 21st Century Fox, one of the biggest entertainment deals in history.

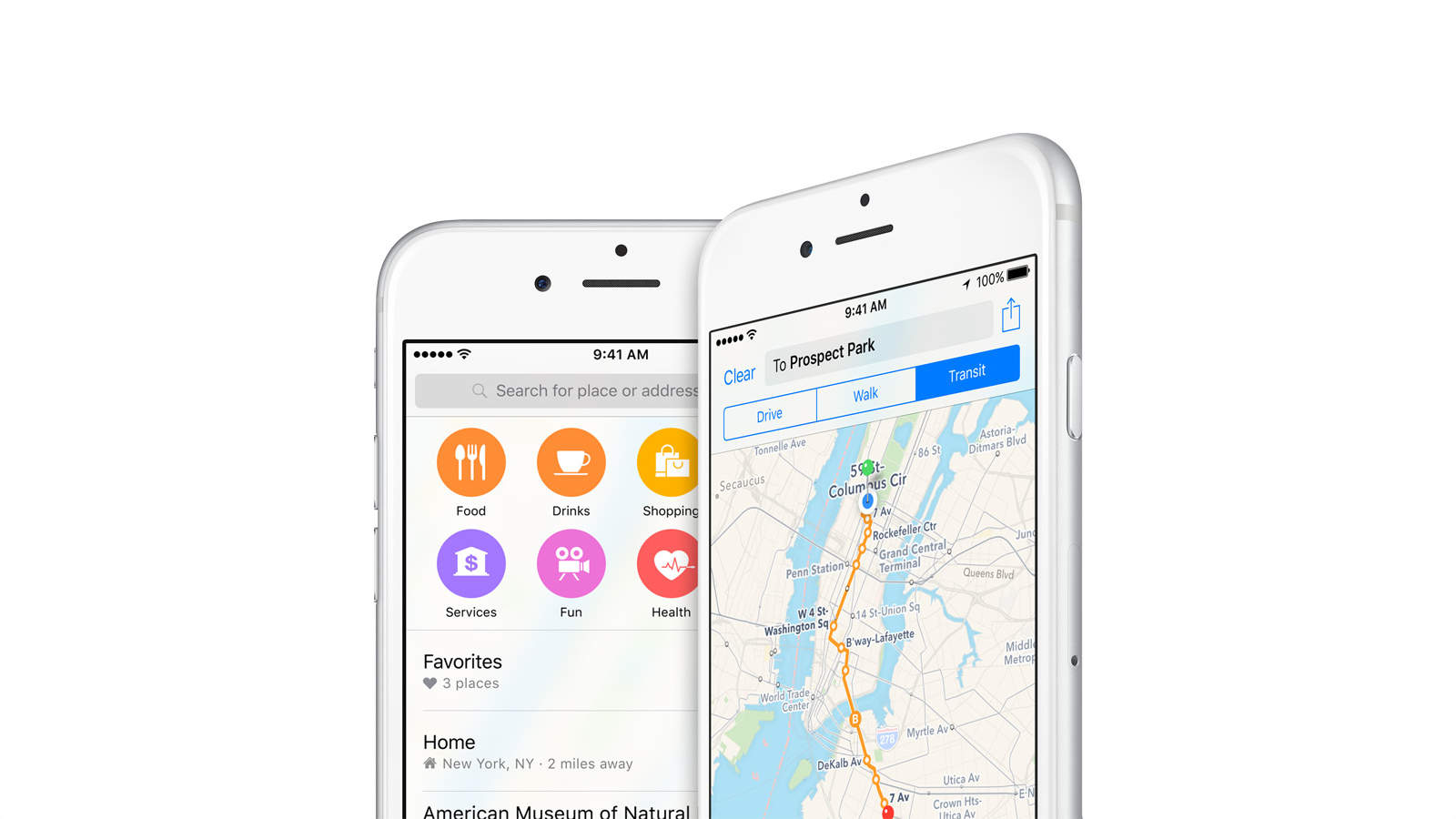

The $71 billion deal puts Disney in control of Fox’s movie and TV studios, the FX networks, National Geographic, and India’s Star India station. It also puts Disney is its strongest position yet to challenge the might of Netflix — along with whatever streaming service Apple comes up with.

![Why Apple should buy Tidal (and why it shouldn’t) [Friday Night Fights] fnf](https://www.cultofmac.com/wp-content/uploads/2016/07/fnf.jpg)