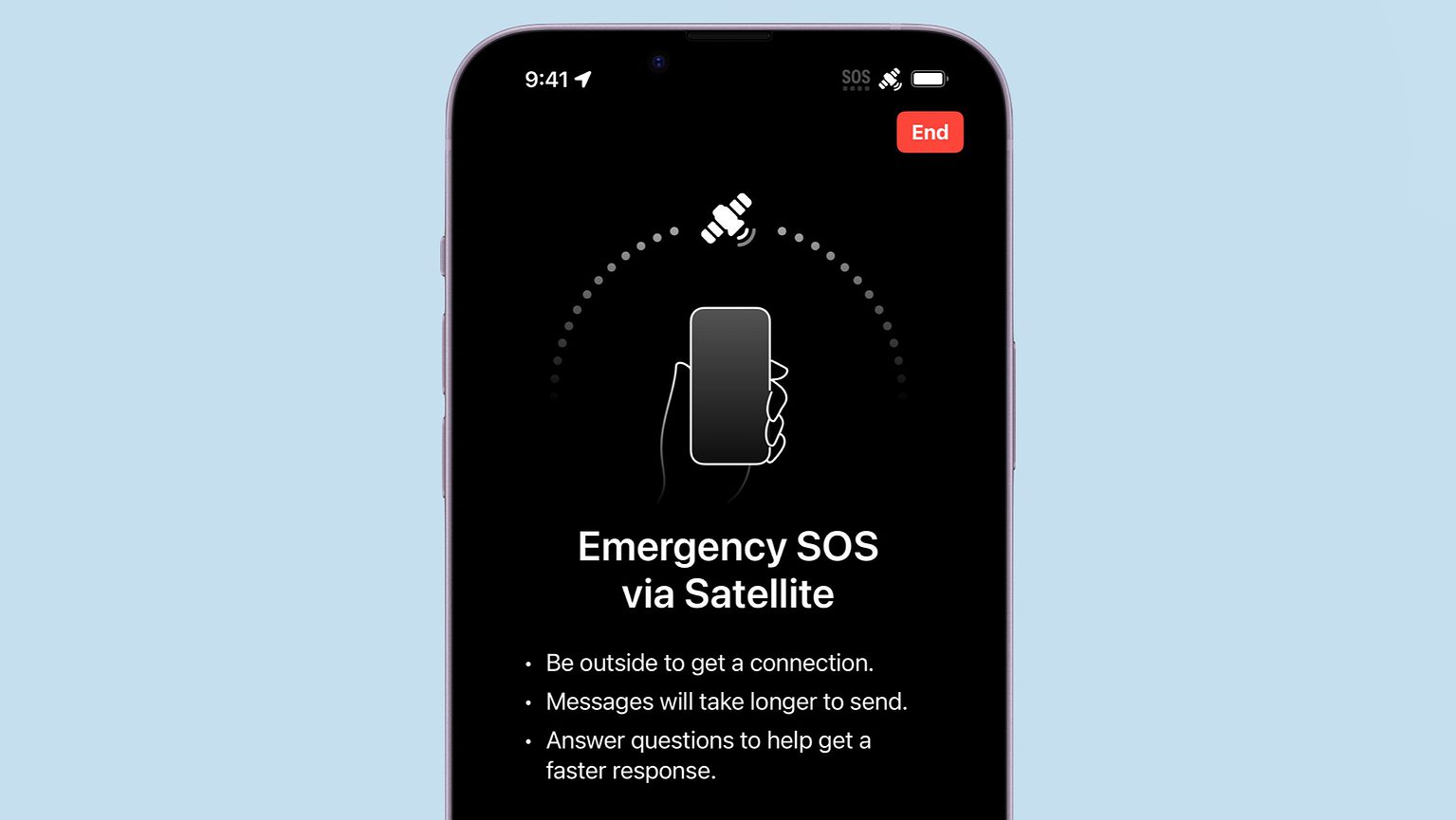

Apple is expanding iPhone 14’s Emergency SOS via satellite feature to more countries. The feature is now available to iPhone 14 owners in the United Kingdom, France, Germany and Ireland starting today.

Emergency SOS was only available in the United States and Canada so far. Apple previously confirmed the feature would expand to more countries in December.