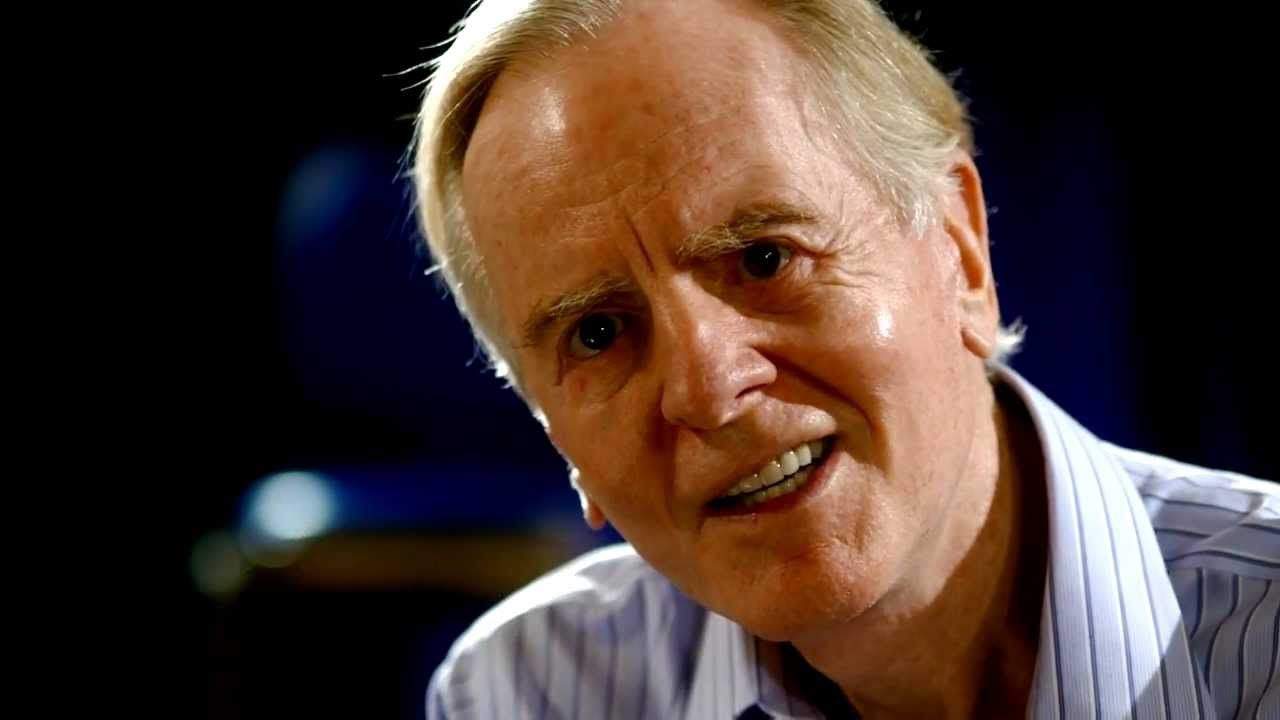

Apple isn’t being valued as a creative leap company so much as it is a predictable cash machine, says former CEO John Sculley.

Speaking with India’s Economic Times about the launch of his latest venture, pCell — a technology that allows huge amounts of data to travel on spectrum-crunched wireless networks, while offering faster speeds and fewer call drops to customers — Sculley gave his opinion of Apple’s current situation:

“Google and Apple are like ATMs, they just keep generating cash. Google takes more risk than Apple. Apple tends to stay the course, and this year is a very big year for Apple in terms of products. It’s not clear that they’re going to demonstrate a creative leap this year despite the products, like they did when Steve Jobs was leader. I think it’s probably unfair to expect them to have a creative leap every five years.”

Sculley was CEO of Apple from 1983 to 1993. Under his leadership, annual sales grew from $800 million to $8 billion, although successful innovation stifled thanks to misfires like the Newton MessagePad handheld.

Sculley has previously been very complimentary of Tim Cook — describing him as “doing a terrific job” — while also acknowledging that he is not necessarily the same creative visionary as Steve Jobs.

His words about Apple’s perceived recent lack of innovation have been echoed elsewhere, including from former Steve Jobs biographer Walter Isaacson who earlier this year claimed that Google is leading Apple in terms of innovating.

He later qualified his statement by saying that, while Google is trying more new things than Apple, Apple remains the best at executing its plans.

Source: Economic Times