PayPal announced a major update for its iOS app today that includes a new iOS 7-styled redesign focused on giving users more options to use digital payments at brick and mortar locations.

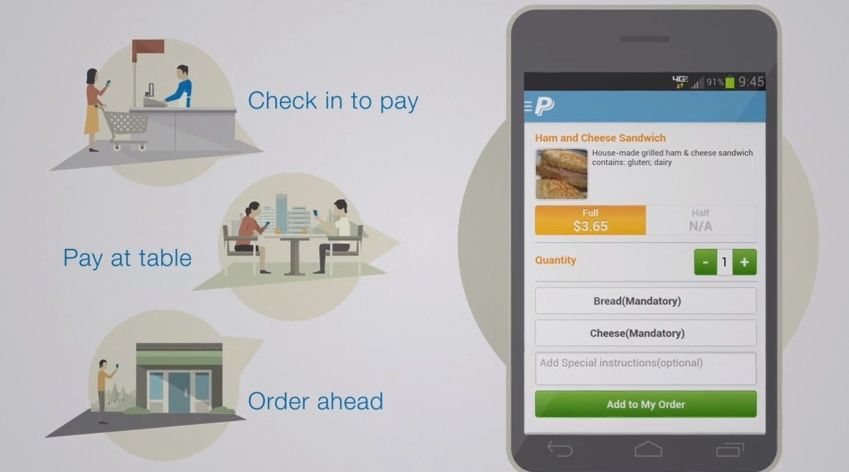

The update allows customers to pay for items in-store, transfer money to friends, split bills, check-in to locations, and even open up a line of credit with the new Bill Me Later feature. PayPal is also working with restaurants to allow users to order and pay for items within the PayPal app, rather than having to download a separate app for all your favorite restaurants.

The new update will be available for free on Google Play and the App Store later today.

Here’s an intro video PayPal released for the redesign: :

![Learn How To Build Your Own E-Commerce Site [Deals] CoM-ECommerceUdemy](https://www.cultofmac.com/wp-content/uploads/2013/07/CoM-ECommerceUdemy.jpg)