The high interest rates offered by Apple Card Savings have now brought in $10 billion in deposits since the service launched in April.

That’s a boon for Goldman Sachs, the bank that holds all that cash and handles the Apple Card, too.

Apple Card Savings accounts pass the $10 billion milestone

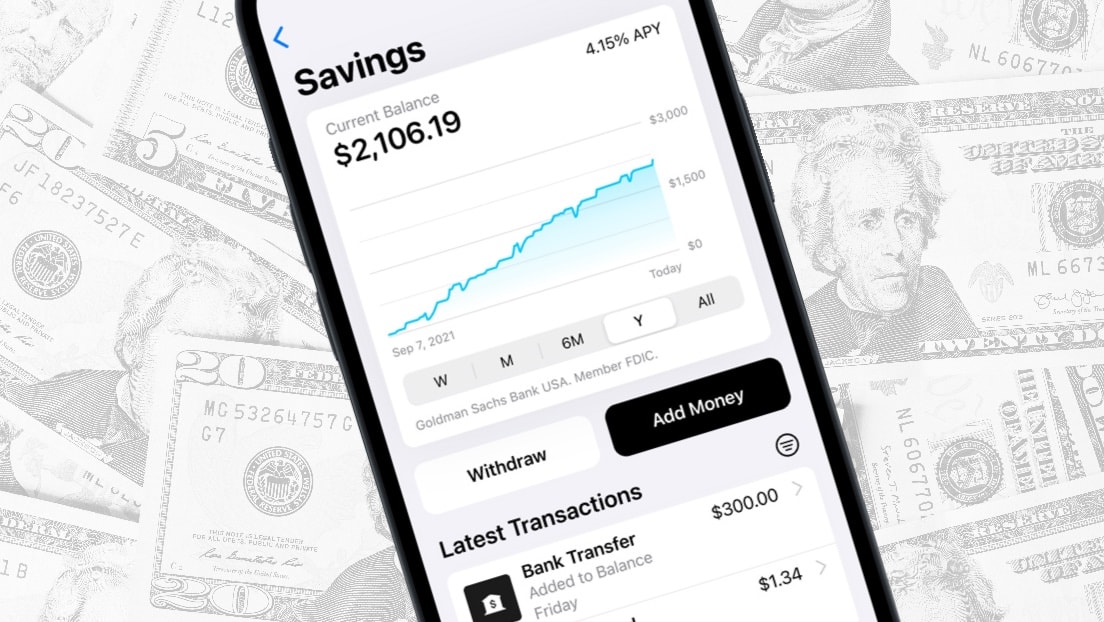

Money earned from Apple Card’s cash-back program can automatically go into a high-yield savings account. And it is high-yield — at 4.15%, the annual rate is about 10 times higher than the national average.

And account holders also have the option to transfer additional money from low-yield accounts at other banks into this one that’s administered by Goldman Sachs.

Clearly, many customers are taking advantage of both options. Reportedly, almost $1 billion poured into Apple Card Savings accounts in first four days after the launch. And now, about four months later, Apple revealed Wednesday that the deposit total surpassed $10 billion.

“With no fees, no minimum deposits, and no minimum balance requirements, Savings provides an easy way for users to save money every day, and we’re thrilled to see the excellent reception from customers both new and existing,” said Jennifer Bailey, VP of Apple Pay and Apple Wallet.

Get on the bandwagon

Users of Apple’s credit card get a percentage of every purchase back. It’s called Daily Cash and is added to the customer’s Apple Cash each day. It’s usually 1% or 2% of purchases.

This used to flow into Apple Cash, but now it can go into an account where it earns interest instead.

Apple Card holders who want to start earning 4.15% annual interest should read the Cult of Mac guide on how to sign up for Apple Card Savings.

But note that the service is for Apple Card holders only. People without this credit card cannot open a savings account with Apple.

Good news for Goldman Sachs

Goldman Sachs is traditionally a bank for businesses. But several years ago it made the decision to go onto personal banking for consumers. It’s not going well.

The bank is allegedly having trouble turning a profit, and reportedly wants out of the partnership that has it backing the Apple Card and other financial services. That comes after losses of at least $1 billion on the deal.

But $10 billion sitting in savings accounts is money Goldman Sachs can invest and profit from.