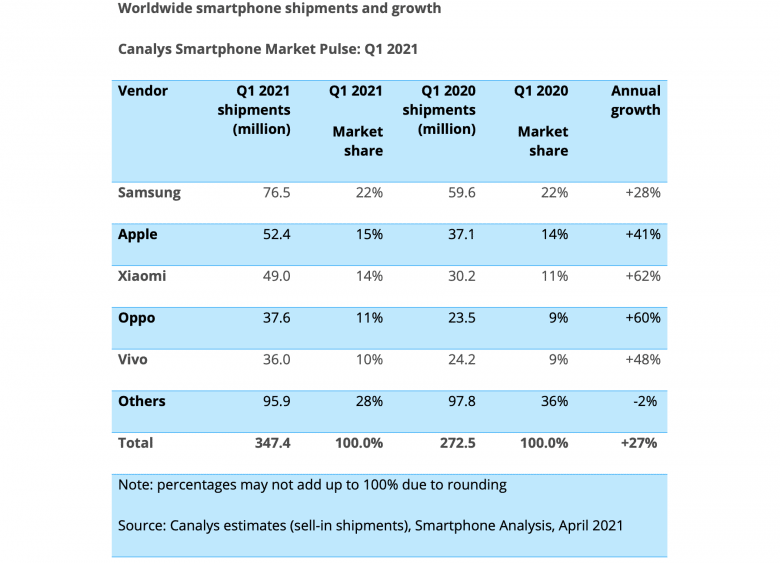

Samsung beat Apple to retain its spot as the world’s no. 1 smartphone manufacturer, new market analysis carried out by Canalys suggests.

In a newly published piece of research, the firm claims that Samsung shipped 76.5 million smartphones in the first three months of 2021. That’s 24.1 million more handsets than Apple’s 52.4 million.

The firm notes that Apple performed well in the quarter due to its iPhone 12 models and strong demand for last year’s iPhone 11. However, the iPhone 12 mini has reportedly “sold below expectations” for the firm: something we’ve reported on before.

Chinese manufacturer Xiaomi also put on a strong showing. The firm recorded its best ever quarterly performance with shipments if 49 million units. That puts it within striking distance of Apple, although Apple’s iPhones make far more in profit per unit and sell for much more.

Overall, the report suggests that worldwide smartphone shipments increased 27% year-on-year to hit 347 million units. Of this, Apple has a reported 15% share.

Photo: Canalys

What does the next quarter hold?

The new Canalys figures come one day after Apple announced its record-breaking quarterly earnings. In the March quarter, iPhone revenue increased 65% to rake in a total of $47.9 billion. While Apple doesn’t reveal sales breakdowns of its different iPhone models, this backs up a lot of the previous reports claiming the iPhone 12 may be Apple’s biggest iPhone since the top-selling iPhone 6 approaching one decade ago.

Overall, the report represents some great news — especially when it comes to reversing the stalling trend of smartphone sales over the past several years. But trouble is brewing for some, and it can’t be blamed on coronavirus much longer.

“COVID-19 is still a major consideration, but it is no longer the main bottleneck,” said Canalys Research Manager Ben Stanton. “Supply of critical components, such as chipsets, has quickly become a major concern, and will hinder smartphone shipments in the coming quarters. And it will drive global brands to rethink regional strategies. Some brands, for example, have de-prioritized device shipments in India, amid the new COVID-19 wave, and instead are focusing efforts on recovering regions, such as Europe. And while the shortages persist, it will grant larger companies a unique advantage, as the global brands have more power to negotiate allocation. This will put further pressure on smaller brands and could force many to follow LG out of the door.”

Source: Canalys