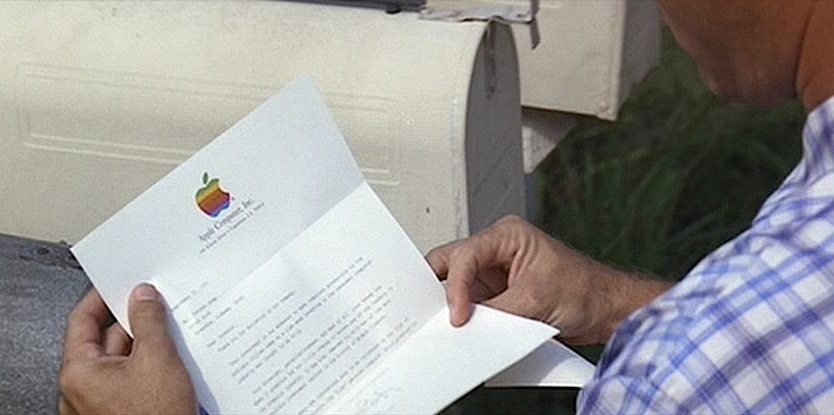

In the Oscar-winning movie Forrest Gump, there’s a short scene in which Tom Hanks’s character opens a letter of thanks from Apple after his former military colleague and business partner Lieutenant Dan invested some of the profits from the Bubba Gump Shrimp Company in “some kind of fruit company.”

It’s been 25 years since that movie debuted. If Gump was real and if he was still clinging on to his investment today, his investment in the Cupertino company would worth around $28 billion.

![Workin’ For The Man: Apple Retail Employees Scrutinized In New York Times Profile [Report] Malkovich has Siri telling jokes, but Apple's fans are far from amused.](https://www.cultofmac.com/wp-content/uploads/2012/06/apple.jpg)