Experian now includes small consumer loans made through Apple Pay Later on consumers’ credit reports. That makes Apple the first “buy now pay later” provider to supply this information to the credit reporting agency.

This can improve the customer’s credit score.

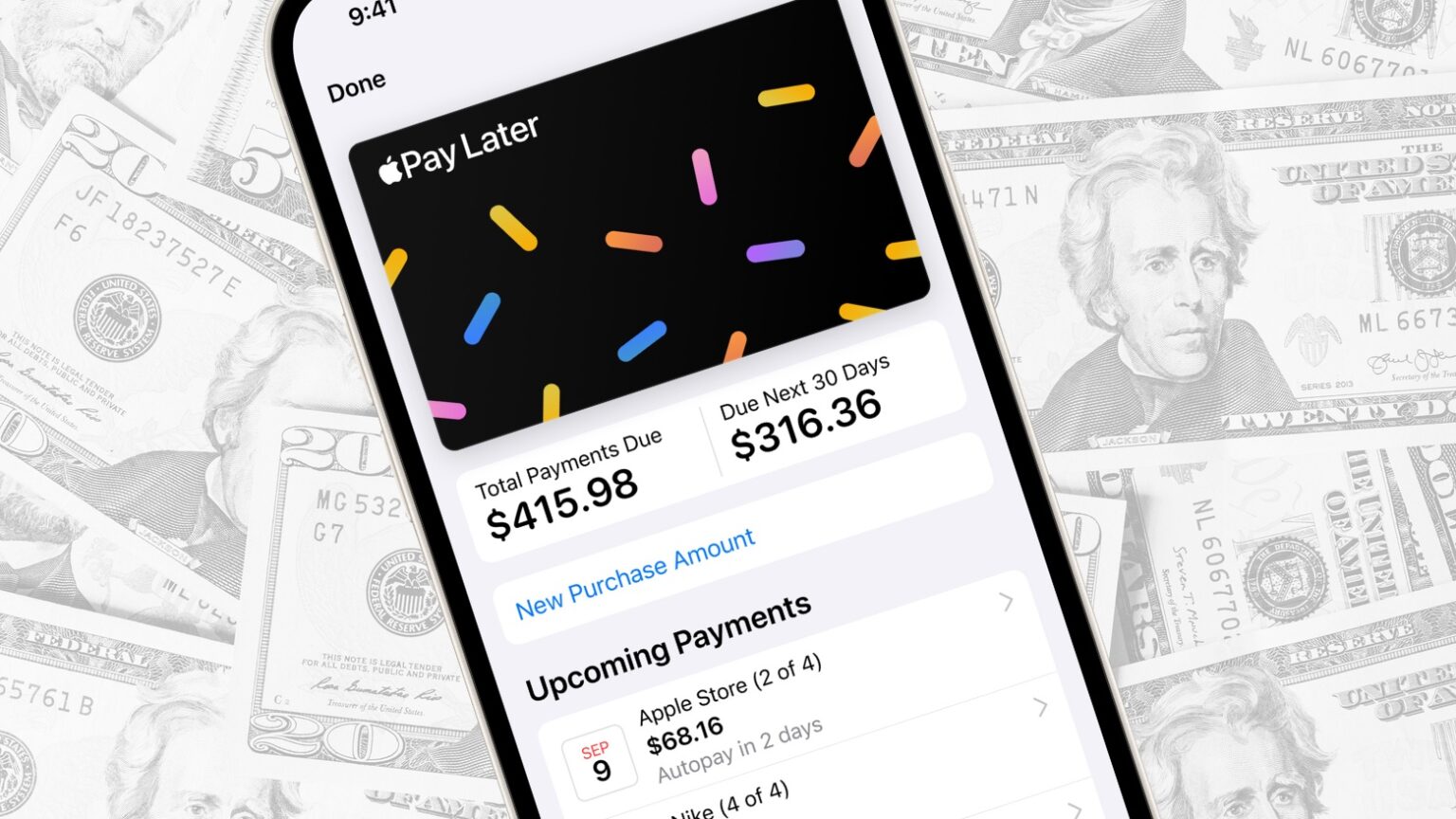

Apple Pay Later goes on your credit score

Apple Pay Later launched in 2023 and allows consumers to pay off purchases of under $1,000 in installments spread over six weeks. No interest or fees are charged even if the loan is paid off late. And it’s not only for Apple products — the service can be used for any expensive item.

And now these small loans are reported to Experian to go onto consumers credit reports.

“We designed Apple Pay Later with our users’ financial health in mind, and an important part of this is ensuring that their loans are reflected in their overall financial profiles,” said Jennifer Bailey, Apple VP of Apple Pay and Apple Wallet. “By reporting Apple Pay Later loans to Experian, we aim to help promote greater transparency and responsible lending for both the borrower and the lender, while providing users with the opportunity to further build their credit.”

It’s a good thing. Really.

Some inexperienced consumers assume that they start off with a good credit score and only lower it by making mistakes. In reality, people start off with no credit score and only build one by taking out loans then paying them off. Or not paying them, as the case may be.

By reporting the results of Apple Pay Later loans to Experian, Apple is helping consumers build their credit score by giving them the opportunity to demonstrate that they can pay off a loan.

Some financial advisors recommend that people take out small loans — even for items that they can afford without them — simply to improve their credit score. Apple Pay Later would be ideal for this because it doesn’t charge interest.

But doing so won’t bring an immediate change to the credit score. As noted, Apple is the first to furnish BNPL data to Experian so the data is not yet incorporated into credit scoring models.