Australian banks including Westpac, ANZ and Macquarie have announced that they will soon accept contactless payments made via Android Pay — although would-be Apple Pay customers are still being left out in the cold.

The reason? Banks still aren’t happy with Apple’s terms for its mobile payments solution, and showing that they are willing to accept Android Pay is a way of forcing a better deal with Apple.

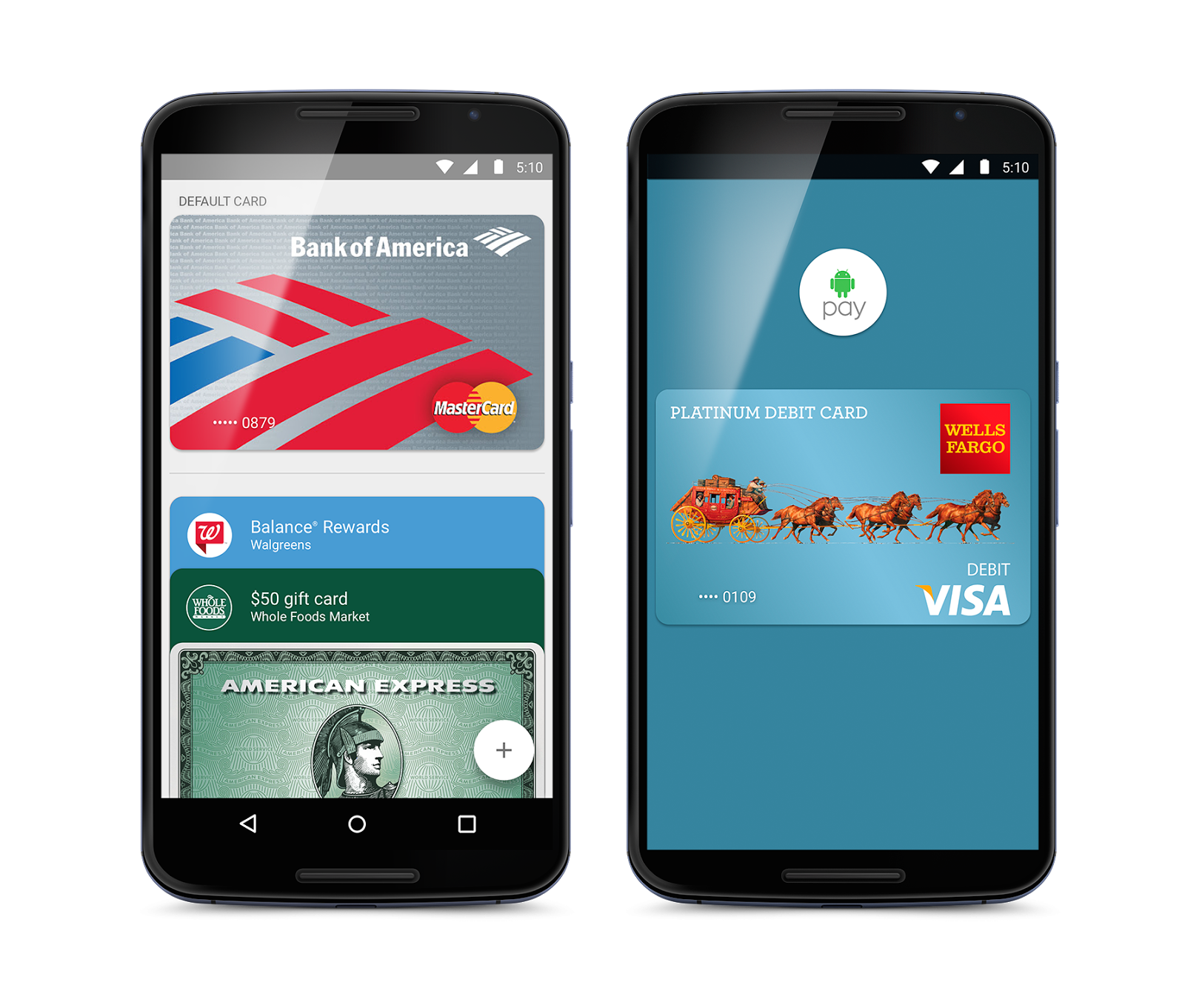

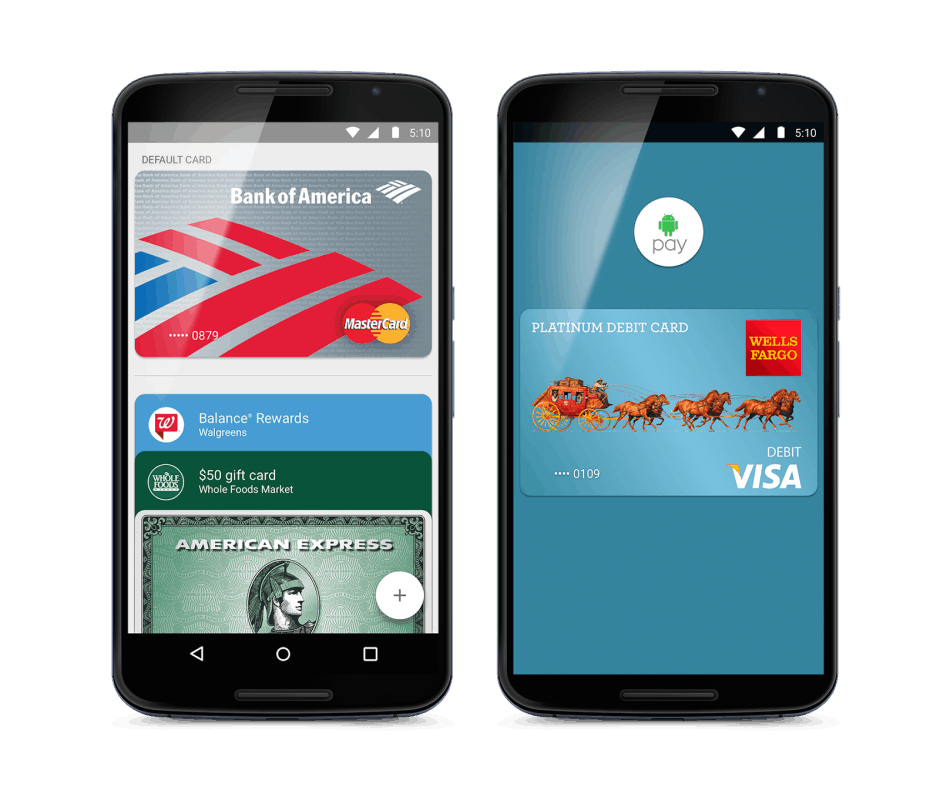

The Android Pay system is set to roll out in the first half of 2016. Android Pay will support both MasterCard and Visa credit and debit cards, while major companies including McDonald’s and Domino’s Pizza have already signed up.

According to ANZ Bank, more than 60 percent of card transactions in Australia are contactless. The next site of expansion for Android Pay is China in the first half of 2016, Google has confirmed.

And as for Apple Pay? The problem still comes down to the fees Apple wants to charge for the service. In the U.S., Apple reportedly earns around 15¢ for every $100 of transactions, while transaction fees come to about $1 per $100. In Australia, meanwhile, banks make the equivalent of just 50¢ per $100 — although Apple is still demanding the same 15¢ cut.

Apple Pay has arrived in Australia on a limited basis for AmEx customers, but for the majority of people it’s not accessible. Australian Labor spokesman on digital innovation, Ed Husic, recently wrote to both Australia’s Reserve Bank and the Australian Bankers’ Association, arguing that retail banks in the country have unfairly “boycotted” Apple Pay.

Source: Reuters