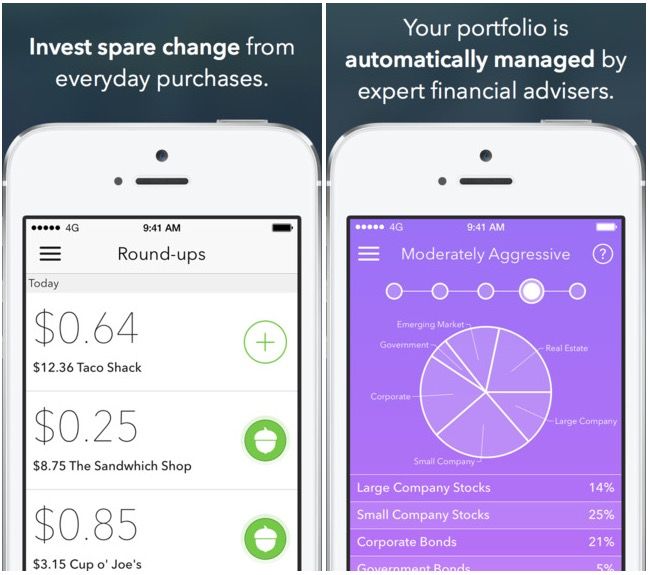

Many of us want to invest, but don’t know how to start. Acorns is a new, free to try app that makes investing as easy as using your debit card and rounding up the change to the nearest dollar.

Available as a slick and beautiful iPhone app, Acorn connects to your bank account or credit card. Any time you make a purchase, the spare change from that transaction is rounded up to the nearest dollar, and then automatically funneled into an investment portfolio that is automatically generated for you. You can then adjust your investment level, how aggressively you want to invest, how conservative you want to be in your investments, and so on.

I signed up for a test account, and while I haven’t made any investments yet, I really like what I’ve seen of the app so far. It’s painless to set up, it seems very secure, and it’s cheap: you’re only charged after you invest, at which point, Acorn costs just $1 per month, plus a management fee ranging from 0.25% and 0.5% of the total assets in your account.

I’m a Bank of America customer, and one of the services I sign up for is called Keep the Change, in which all of my debit card transactions are rounded up to the nearest dollar, with the extra cents going into my savings account. About a year after I started doing that, I looked in my Savings Account, and saw that Keep The Change had generated almost $1,000 in charges over that period.

I like to think someday, using Acorn, I’ll have the same pleasant surprise in store for me… but hopefully, for a lot more cash.

Source: iTunes

Via: Laughing Squid