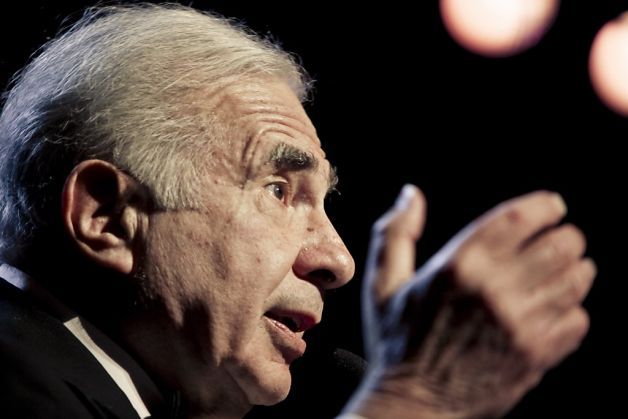

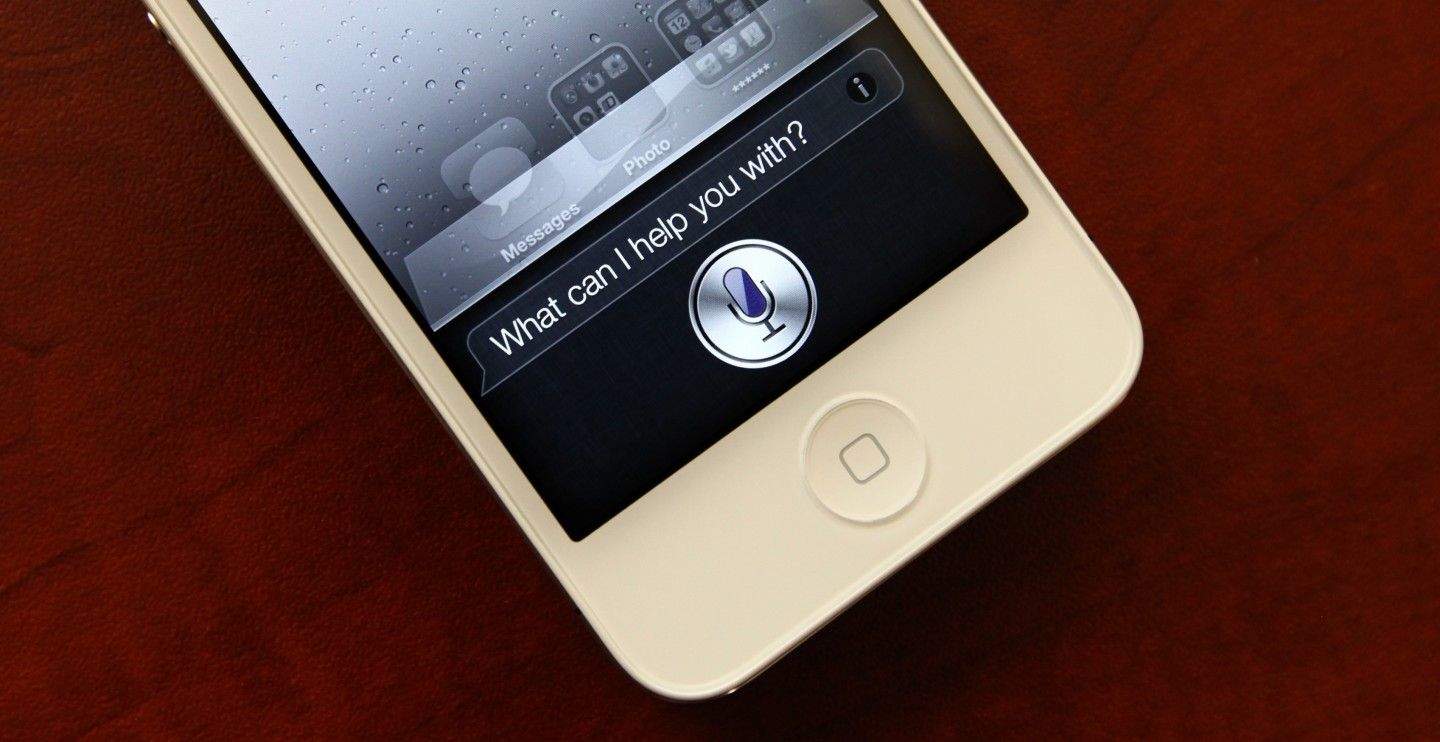

He may feel more than comfortable publishing an open letter to Tim Cook calling for Apple to engage in an immediate $150 billion buyback of shares, but (vocal) activist investor Carl Icahn has said that he would never push Apple to buy Nuance Communications Inc., maker of the software that runs the Siri feature on Apple’s iPhones.

Carl Icahn: Why I Wouldn’t Tell Apple To Acquire Siri Software Makers

Photo: Forbes