Apple CEO Tim Cook turned some of his millions of Apple shares into cash. He reportedly netted about $41 million from the sale.

Unlike some CEOs, Cook owns only a minute share of the company he runs.

Apple CEO Tim Cook turned some of his millions of Apple shares into cash. He reportedly netted about $41 million from the sale.

Unlike some CEOs, Cook owns only a minute share of the company he runs.

Apple CEO Tim Cook is one of the best paid U.S. executives according to a new report. He pulled in a whopping $265 million in 2020 from his salary, bonus, and stock awards.

But that’s chump change compared to what Elon Musk made.

The CEO of Apple reportedly passed a huge milestone: He’s now a billionaire. Tim Cook’s net worth has risen significantly, partially as a result of Apple stock more than doubling in value in the past 12 months.

But Cook is not likely to stay a billionaire. And not for the reason you might think.

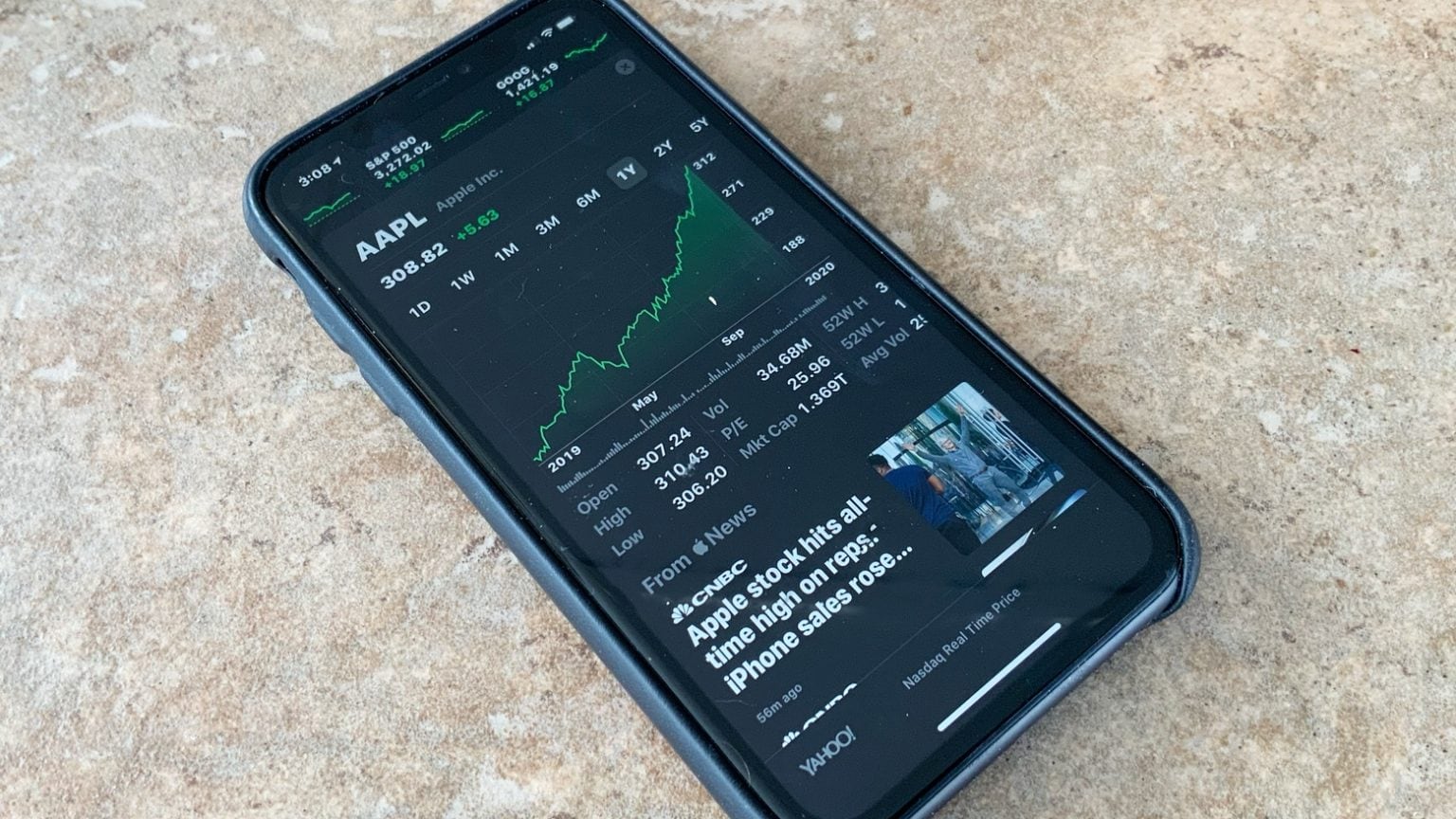

If you bought Apple shares on Jan. 9, 2019 then you’ve doubled your money since then. And while Apple certainly had a good year, it’s not done yet.

Analysts are predicting big increases in the share price because of the company’s changing mix of products — it’s not just an iPhone maker any more.

Apple’s stock buybacks in Q1 totaled more than any other S&P 500 company by a wide margin. The iPhone maker poured $23.8 billion into purchasing its own shares, more than it has ever done before. And that’s saying a lot, as Apple been spending billions on buybacks for many years.

If you’ve been thinking about investing in Apple stock, an analyst from Morgan Stanley says this is to time to do so. The price is already low, and not likely to go any lower.

There’s been bad news for Apple recently but that’s already priced into the stock.

Apple stock price has dropped steadily throughout June. That likely bothers short-term investors, but not Tim Cook. Apple’s CEO thinks long-term, and says planning no farther than the next quarterly earnings report is a recipe for disaster.

“If you’re making a decision based on the short term investors, you’re going to be guaranteed to be making terrible decisions,” Cook said yesterday.

Apple stockpiled $252.3 billion overseas, but it’s bringing that money back to America. A market analysts predicts the company will spend $100 billion of it on its stock buyback and dividend program. This will directly benefit those with Apple shares.

The company decided to bring the money home from foreign banks after the new GOP tax law gave companies a limited time for cash repatriations at lower rates, possibly just 8 percent.

Apple hosted its annual shareholders meeting today at the company’s headquarters in Cupertino where a number of new proposals were presented by investors before Tim Cook took questions from the audience.

During his Q&A session, Tim Cook discussed how Apple plans to fight for net neutrality. He also assured shareholders that Apple plans to come out with new products that appeal to professionals and creatives, but insisted that the Mac and iPad aren’t destined for a merger.

Apple’s stock continued its historic rise today by setting a new all-time intraday high before closing at its highest price ever.

It’s a great time to be an Apple shareholder.

Aided by a increased confidence rating from Goldman Sachs, Apple shares hit an all-time high today, with the price jumping to $133.76 per share before closing just above the company’s previous record of $132.54, set on May 17, 2015.

Buoyed by expectation-defying earnings, Apple Pay, and an apparently insatiable demand for the iPhone 6, AAPL stock closed Wednesday at a new all-time split-adjusted high of $107.3.

Apple was trading at $92 at the time of the 7-to-1 split, which means that its current value is up by more than 10% since the division earlier this year. According to Google Finance, Apple ended the day with a market cap of $626 billion, and $629.67 billion as per Yahoo Finance.

For a company that people are either making fun of, or else talking about overtaking — Apple sure is doing well these days, isn’t it?

![Apple Stock Will Hit $1000, Says Gene Munster [Report] I'd dance, too, if I still owned all those AAPL shares I had in the 90s](https://www.cultofmac.com/wp-content/uploads/2012/05/Munster-Apple-Bullish.jpg)

Not only does Piper Jaffray analyst Gene Munster see Apple’s and its investors’ financial outlook as essentially rosy for the foreseeable future, but he’s taking it one step further. He’s convinced that he has at least ten reasons to stay bullish on Apple stock over the next three years. He also thinks the stock price is going to hit $1000 per share.

After weeks of wild price swings, Apple’s stock closed today at its highest value ever, $420 a share. The previous high was about $413; many were expecting that value to fall tremendously when (my hero) Steve Jobs passed, but to much surprise Apple’s stock remained relatively unaffected by his passing.

The new high comes right before Apple’s Q4 FY11 earnings report and conference call next week (Tuesday, Oct. 18th). This will of course be their first earnings call since Steve Jobs’ passing, and though I think the report will be their usual “we made ALL the money we win” type, whatever success they have had will surely be sobered by the loss of their visionary CEO and friend Steve Jobs.