The most yawn-inducing Apple earnings call of the year is just days away, and Wall Street is eagerly anticipating the results — though maybe for reasons you wouldn’t expect.

Apple CEO Tim Cook and CFO Luca Maestri are scheduled to hop on the phone with investors at 2 p.m. Pacific next Tuesday for Apple’s Q3 2019 earnings call. Even though Apple doesn’t reveal quarterly sales for iPhones anymore, there are a lot of metrics to look for that could clue us in on how well or poorly the company is performing lately.

Keep an ear out for these five things during Apple’s July 30 earnings call.

![What Apple’s past says about its future [Cult of Mac Magazine No. 282] Hey, that's no crystal ball ... Apple earnings offer a peek at Apple's future.](https://www.cultofmac.com/wp-content/uploads/2019/02/com_magazine_cover_282a.jpg)

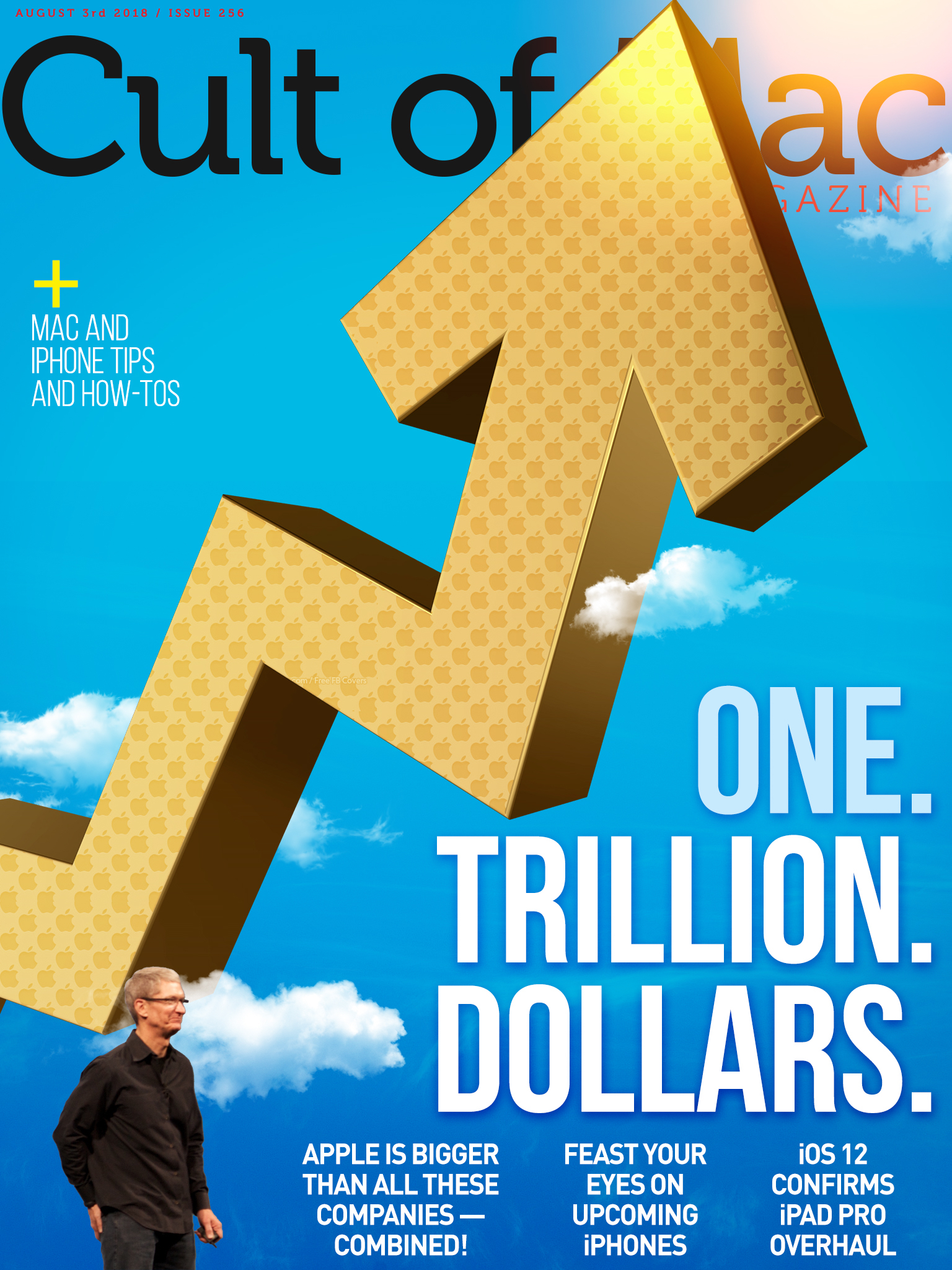

![Apple’s 2018 hardware blitz! [Cult of Mac Magazine] What a week! New Apple hardware and an earnings surprise.](https://www.cultofmac.com/wp-content/uploads/2018/12/Cult-of-Mac-Magazine-No.-269.jpg)

![Apple earnings: Can Cupertino’s latest surprise save the Street? [Live blog] Will Apple reach its own targets for Q2?](https://www.cultofmac.com/wp-content/uploads/2016/04/Earnings_Call_1.jpg)