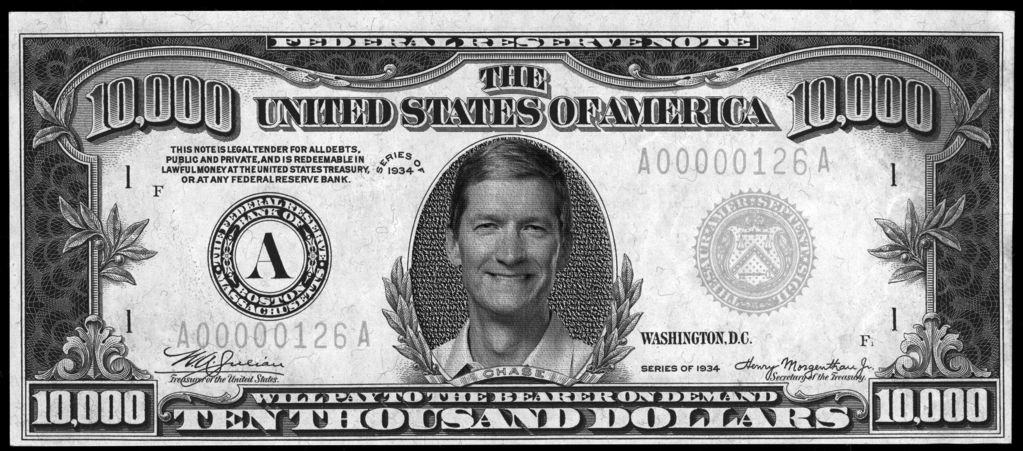

Apple’s stock made up more than $400 billion over the last nine months and ended today a $1 trillion company.

It’s a remarkable recovery, considering Apple closed the day on Jan 3. at $142.19 a share. Today, Apple’s shares rosed 3.2 percent to close at $223.59 for a $1.01 trillion market capitalization.