JPMorgan Chase now offers an all-digital bank account. Finn by Chase is for people who prefer to do everything on a phone, as this checking and saving account is only accessible on an iPhone or iPad.

To grab people’s attention, the bank will give $100 to new customers who complete at least 10 qualifying transactions within 60 days of opening the account.

Finn by Chase can be used to pay bills on your smartphone or tablet, though it doesn’t include paper checks. No credit card is included, but a debit card is. Or you could connect these accounts to Apple Pay.

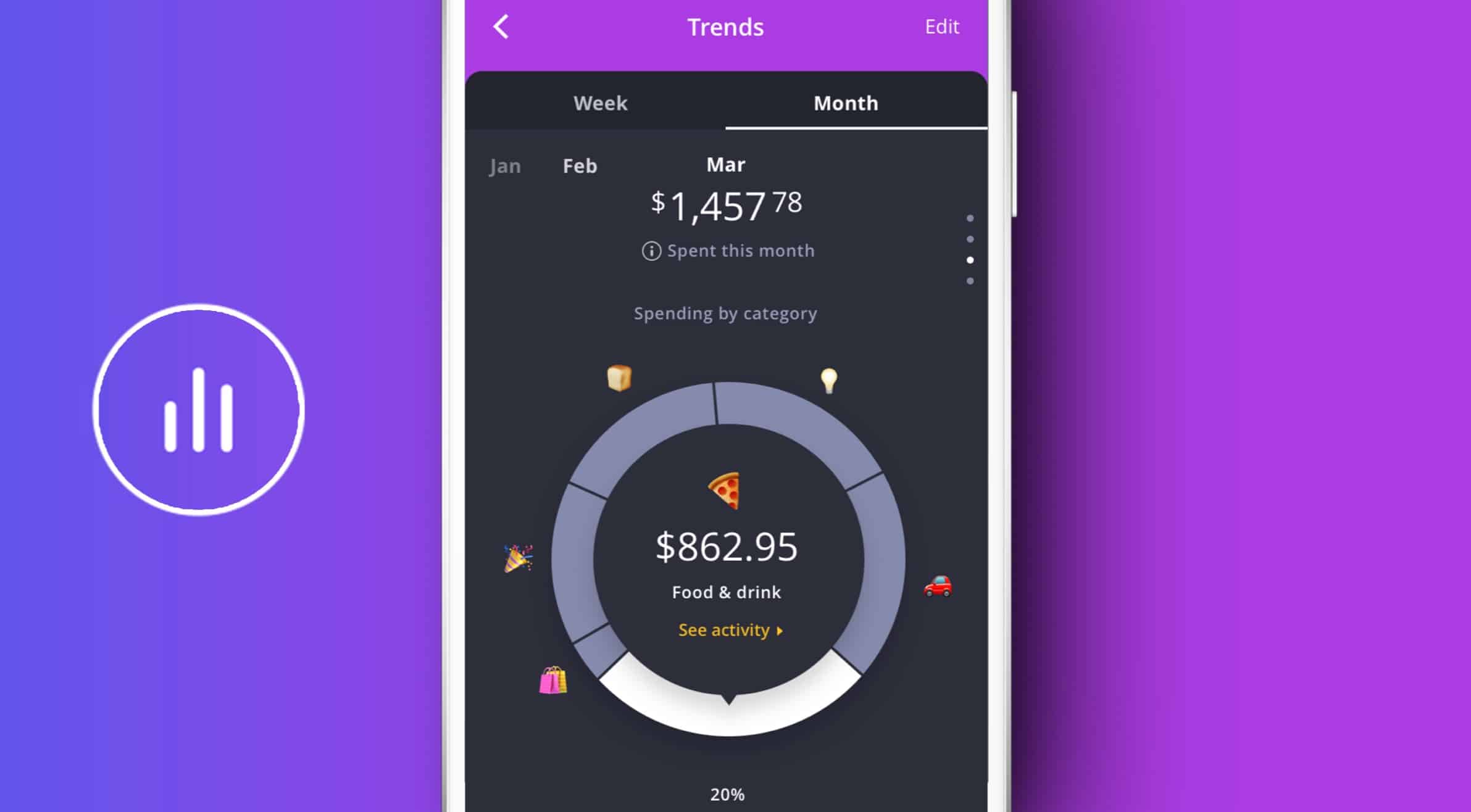

The free iOS app comes with tools to help you track your spending. You can even rate your purchases. And auto-save rules can be set up to make transferring money into the savings account easier.

No teller for you

What Finn by Chase account holders can’t do is go to a brick-and-mortar bank location to make transactions. You can go to ATMs to withdraw cash, and JPMorgan Chase belongs to a huge network of these where there are no fees. Everything else must happen on the iPhone or iPad, including depositing checks.

As JPMorgan Chase points out, “Finn is an all mobile bank, so yeah, you need an Apple iPhone (6S or higher). And we’re working on an Android version.”

The savings account offers modest interest rates. There are no service fees on either type of Finn by Chase accounts. But there is also no rewards program for making purchases.

As for that $100 bonus, don’t start spending it yet. One of the requirements is that you keep your Finn by Chase account for 6 months.