Gone are the days of walking into a bank with your passbook and having your deposit stamped and recorded. Technology and the advent of online banking has eliminated the need to shuffle through the mouse maze line of your local banking institution and has replaced our favorite smiling teller with bright LED screens and Helvetica font. Online banking is a major convenience that saves us time and allows us to stay in our pajamas that much longer.

Online banking has slowly migrated onto our mobile devices with almost every major banking institution now offering a mobile app and despite fears surrounding security, over 30 million Americans accessed their bank via a smartphone or tablet. Interestingly enough, users are more likely to do their banking on a tablet rather than a mobile phone. Perhaps users find the larger interface of a tablet easier to navigate or maybe it’s the more comprehensive apps that banking institutions are developing for tablets, whatever the reason, mobile banking by tablet owners is growing twice as fast as non-tablet owners.

According to a report by Javelin Strategy & Research, they expect this tablet banking trend to continue and with a forecast of an overall tablet adoption rate of 40% by 2016, it would be in the best interest of banks to start working on tablet optimized versions of their apps. According to Javelin Strategy & Research, of the 25 banks that now have Android or iOS apps, only 20% of them have tablet-optimized apps.

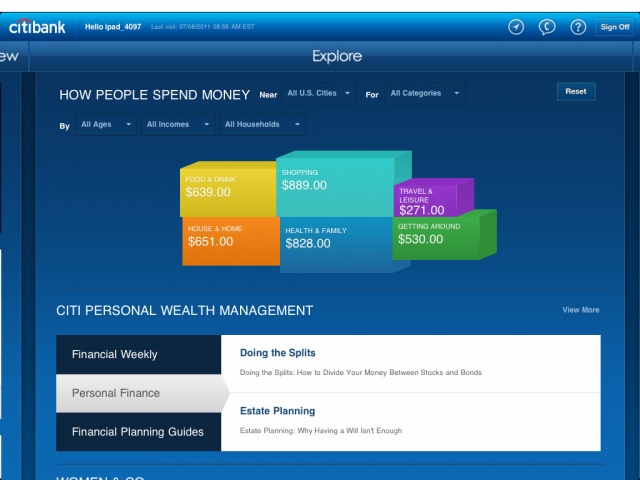

Providing users with an optimized app increases their likely hood of doing their banking on a tablet device and of all the top financial institutions, Bank of America, Citi and USAA have emerged as tablet banking market leaders thanks to their tablet-optimized apps.

The Javeli Strategy & Research also found that:

- Apple holds the top market share with 55%.

- Amazon’s Kindle Fire captured 10% of the tablet market in just a few months.

- Tablet owners have higher rates of mobile person-to-person transfers.

- Tablet owners are young (25-44), wealthy (incomes exceed $100,000 and have more investable assets), and use many bank products.

How about you, do you prefer to do your mobile banking on a tablet? Do you favor a tablet optimized app over the browser? What attracts you most about banking on your tablet as opposed to your mobile phone? How about those of you reluctant to give mobile banking a shot, what would you like to see changed before convincing you to give it a try?