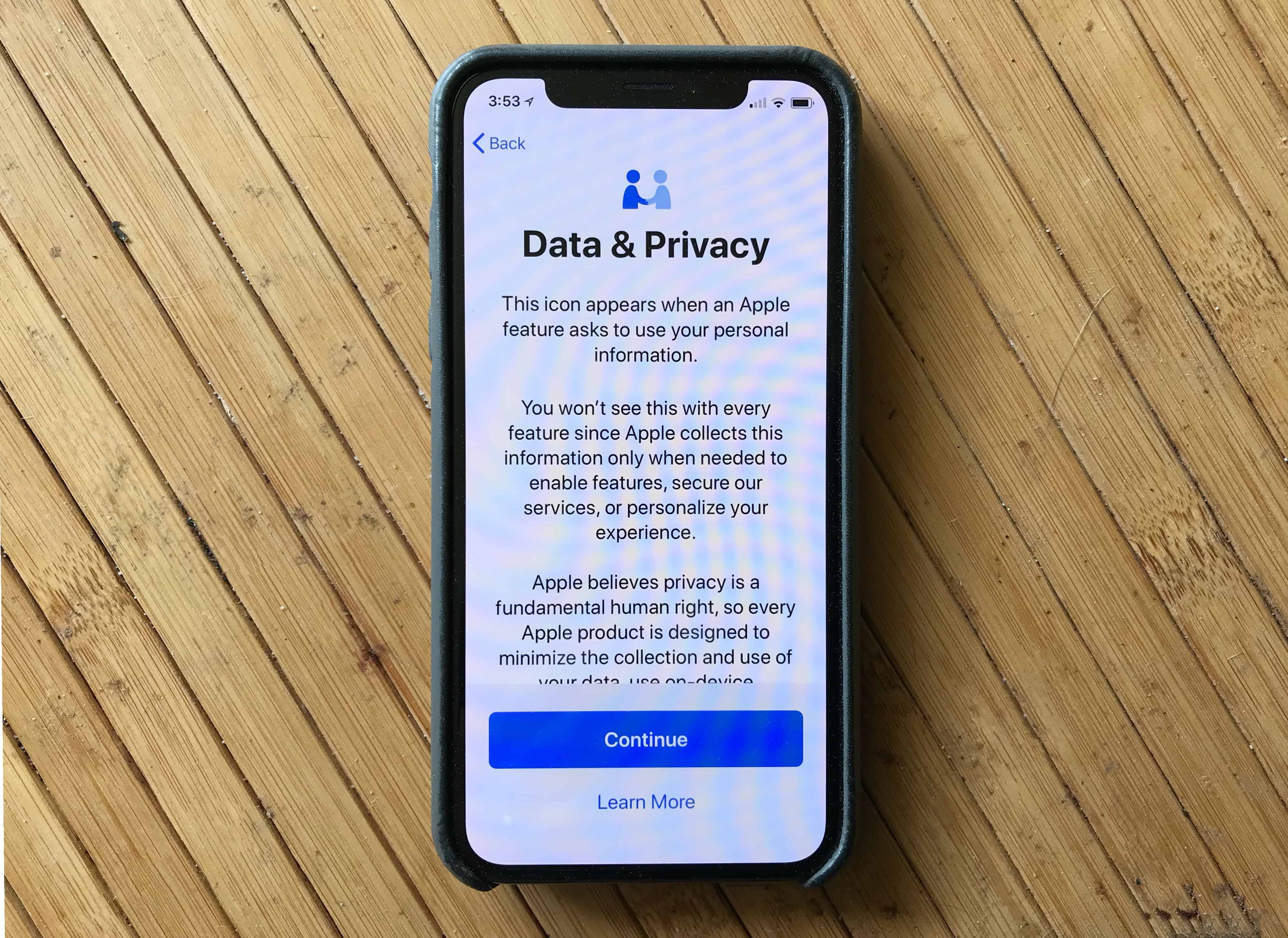

The European Parliament will soon vote on whether to require all phones, tablets and other mobile devices to use a single type of charger. If passed, this could force Apple to abandon its proprietary Lightning port in future iPhones.

EU Parliament debates forcing Apple to kill the Lightning port

Photo: Ed Hardy/Cult of Mac