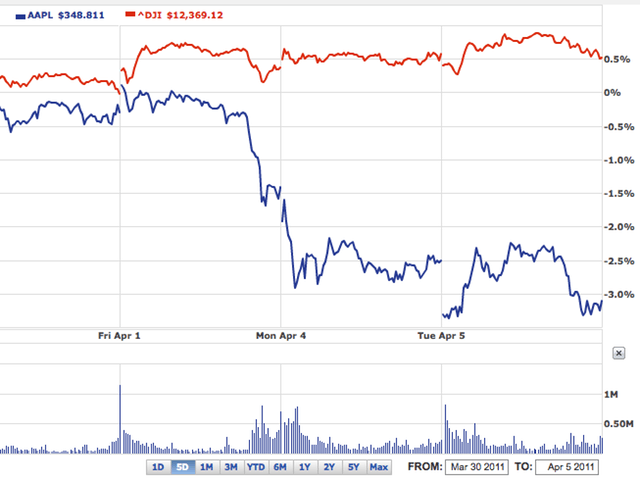

Was there insider trading involved in Monday’s sell-off of Apple stock just prior to news that NASDAQ would rebalance several tech stocks, including Apple? That’s the concern of some investors trying to understand why $4.2 (1.2 percent) was shaved off the high-flying Cupertino, Calif. company.

“Doesn’t it feel as if someone got a call regarding the Apple re-weighting at 2pm on Friday afternoon, when the stock was trading at $348 and change?” Fortune quotes one investor. Monday’s sell-off of Apple shares happened on a “day when the Dow was up and a couple analysts had just raised their Apple target prices,” the magazine adds.

If suspicions are validated, it wouldn’t be the first time Apple stock was involved in insider trading. In Dec. of 2010, an executive at supplier Flextronics was arrested for allegedly leaking details of the upcoming iPhone and iPad. The arrest followed a three-month Securities and Exchange probe.

Ironically, the suspicious Apple trading occurred the same day a Facebook executive was fired for alleged insider trading.

[Fortune]