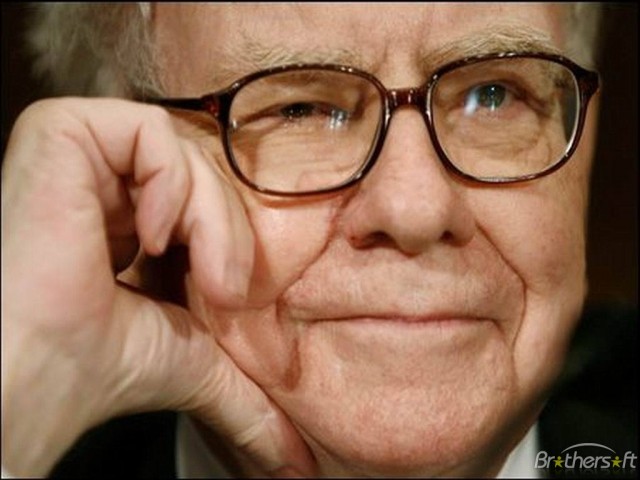

Warren Buffet, the world’s third richest man, has an aversion to buying Apple stock… because he just doesn’t get them.

“We held very few in the past and we’re likely to hold very few in the future,” said the billionaire chairman of Berkshire Hathaway. “[It is] very easy for me to come to a conclusion as to what it will look like economically in five or 10 years, and it’s not easy for me to come to a conclusion about Apple.”

My first instinct was to decry this Mumm-Ra of financial wizardry for opening his desiccated gum flap and, with a puff of dust and a voice the sound of an unoiled door hinge slowly creaking open, shouting “I’M OLD!” in this manner.

Then I thought about it, and I realized he was right. I mean, not economically — I have no idea what AAPL stock will look like in five or ten years, although I think he’s right as an investing chairman interested in the long-term to view electronics as a tumultuous market: ten years ago, for example, Microsoft and Dell seemed untoppleable, Apple seemed doomed and no one gave a damn about Google. Apple just isn’t as sure a thing as Coca-Cola over the long haul.

But Buffett’s right in another way, too. I have no idea what Apple will even look like as a company in 10 years, or even five. After all, five years ago, Apple was still primarily an MP3 player maker. Ten years ago, they were primarily a computer maker. Now, they’re primarily a mobile device maker. Twenty years from now, they could be selling us all brain implants for all I know. But unlike Buffett, I don’t fear that. It excites me.