This post is brought to you by You Need A Budget.

Given today’s economy, there’s a good chance you’re a freelancer. The self-employed, as much as and maybe more so than the salaried, can only benefit from being strategic and disciplined in handling money.

Of course many of us don’t have the bandwidth to plan beyond next week, let alone the next six months. But with shifting sources of income and hard deadlines for bills, improvising with your finances is a sure way to lose cash you could be keeping.

You Need A Budget.

That’s more than a fact, it’s also the name of an ingenious budgeting platform that’ll help you effectively manage your money in an intuitive, even fun, way. Sure, you’ve tried budgeting apps before, but they’ve always left you confused or frustrated. YNAB bets they can get you to stick to it by using their cloud-based, adaptive software. Already used by hundreds of thousands of people, YNAB turns financial goals — saving for a wedding, paying off a credit card, making sure you have money for groceries next week — into tangible, meaningful targets, while at the same time helping establish a clear path toward achieving them.

At the heart of YNAB’s system are four rules, which serve as helpful touchstones whether or not you use their software:

Rule #1: Give Every Dollar a Job. Rather than thinking of your money as a vaguely defined pool whose level you check at the end of the month, instead turn it into an adaptive army, with defined priorities, divisions and missions to take the guessing out of spending and saving.

Rule #2: Embrace Your True Expenses. Anticipate the months where large or unexpected payments may occur by structuring them into your spending throughout the year, turning those big payments into smaller, much more manageable chunks.

Rule #3: Roll With the Punches. Instead of sticking to a strict, immovable strategy, adopt an approach that accounts for the unexpected, and carries forward in a way that can quickly cover for any unanticipated spending.

Rule #4: Age Your Money. This can be considered the end goal of YNAB’s system, to gradually save enough of each paycheck to create a buffer zone of a month’s pay so that, over time, you’ll be saving all your new income and spending money you earned months prior.

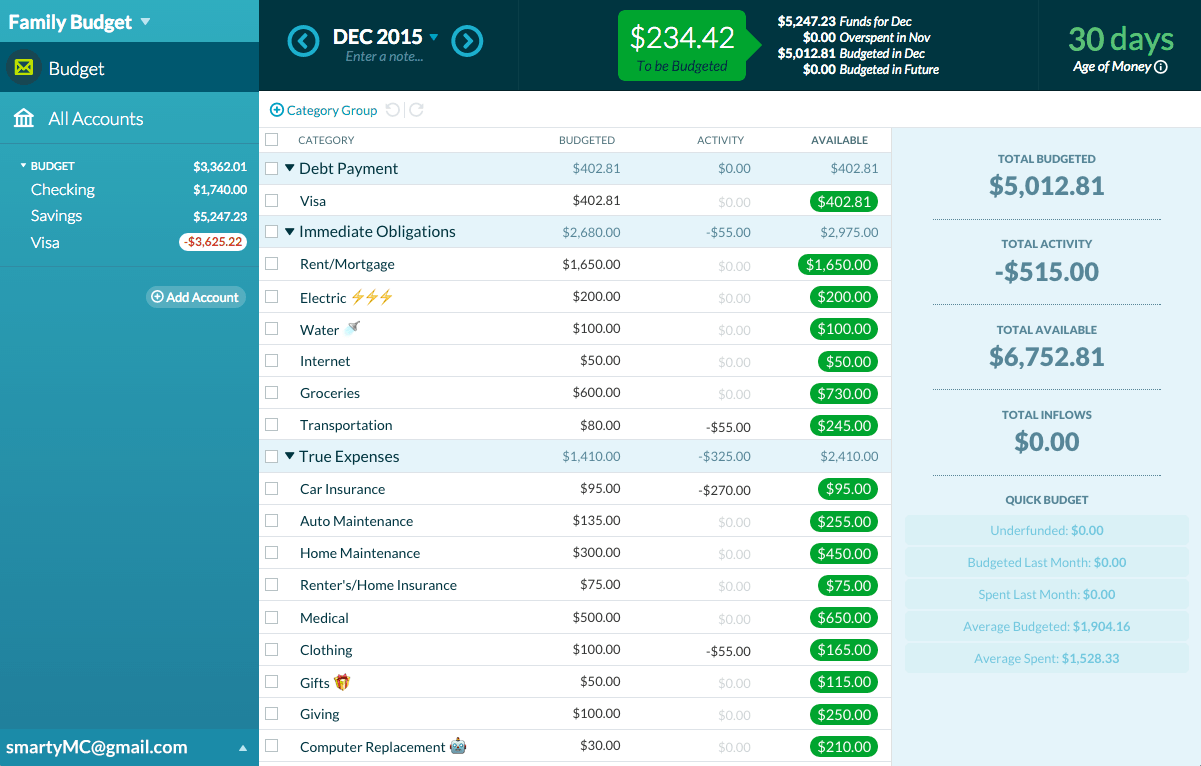

All of the above rules are baked into YNAB via an intuitive web and mobile-based interface and a system of goals and gentle reminders. Each category of spending — rent, groceries, car payments, miscellaneous — is responsive to what you actually spend. A built-in goal-setting system sets in digital stone that you will achieve, say, a certain amount of money in a given account, or having a credit card paid off by a set date. When you fall short, tools like the “Underfunded” button makes it a single-step affair to pull funds from other budgets to right your fiscal ship.

YNAB is all about eliminating the guessing, and embodying the longview in each short-term step. As you use YNAB, an ongoing indicator will tell you how “old” your money is, showing where you’re at on the path to Rule #4.

YNAB is all about eliminating the guessing, and embodying the longview in each short-term step. As you use YNAB, an ongoing indicator will tell you how “old” your money is, showing where you’re at on the path to Rule #4.

All the rest of YNAB’s mechanics are similarly effortless, carefully designed to be easily navigable and actively offer aid in setting up and running your budget, so that you’re fully aware of what you’re spending while actively saving. Over time, your input tunes the budget so that you save more and more of each paycheck.

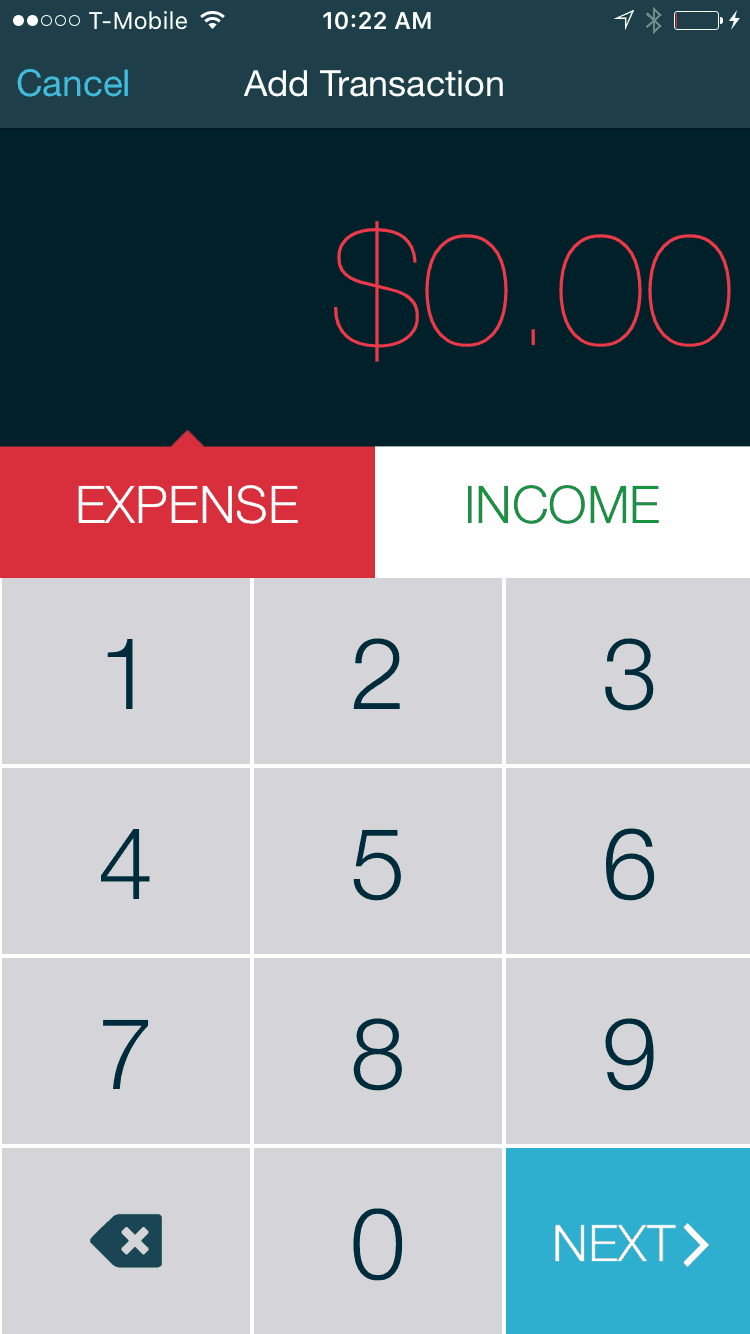

YNAB Is a system that goes easy on the user, eliminating much of the hassle and noise that turns so many of us off to budgeting software. Updating transactions from your bank for example is now a simple matter of clicking the ‘import’ button, and all necessary information is securely transmitted by at third party provider. A simple setup process of budget categories and regular payments communicates with up-to-the-moment purchase updates via YNAB’s iPhone or Android app. It’s also a system that shows results. According to YNAB, after one month the median net worth increase for users is $200. After nine months, it’s $3,300.

Ultimately we all need to budget better, and those of us who don’t budget at all need to get started if we ever want to think ahead of the next paycheck. If you’ve tried a bunch of other budget systems but have been left cold or broke, YNAB is for you.

Skeptical? Give YNAB a try for 34 days, with full features and free of charge.