Apple will announce its second quarter financial results at 5 p.m. EST today, and this could be one of the company’s most interesting earnings calls for some time. Wall Street has been less than optimistic about the Cupertino company’s recent performance, and some believe that Apple will post its first quarter of negative growth income for over a decade.

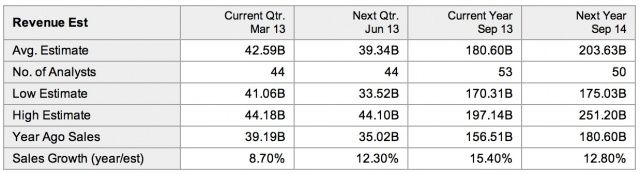

But some analysts are a little more positive. According to averages put together by Yahoo! Finance, Apple is likely to announce revenue between $41 billion and $43 billion for the second quarter, with margins between 37.5% and 38.5%.

We’ve already explained just how crazy Wall Street’s gloomy estimates are, and we’re also well aware of the fact that Apple habitually exceeds those estimates time and time again. Which is why the affect Wall Street is having on Apple’s share price is so insane.

But it appears that between them, analysts have a good idea of how well Apple’s really been doing this quarter. Averages for over 40 analysts predict revenue of $42.59 billion, with earnings of just over $10 per share. They expect Apple to have sold 36.5 million iPhones, 18.3 million iPads, 4.1 million Macs, and 6.25 million iPods.

These expectations are much closer to Apple’s own guidance for Q2 2013, and the company often blows its guidance out of the water. As long as it sees the numbers predicted above, you can expect its share price to go back up again.

Source: Yahoo! Finance

Via: Razorian Fly